Benefits Of Good Credit and Why it Matters

One thing in life that can help things go more smoothly is your access to credit and being able to qualify for good rates when it comes time to borrow. With larger purchases, saving up until you have the funds can take a long time, especially if it were a car or a house.

Credit is a way of life in many countries, which can make life more affordable when properly managed and allow for purchases before saving up and allowing you to have certain things sooner than later. Having good credit has many benefits, but being able to afford certain things sooner would have to be the main one. It also provides peace of mind that when you have a good credit score you would likely be approved for an installment loan or personal loan if the need came up that you need fast funds and don’t have a savings to help you through things.

Better Borrowing Options

If you have been denied loans or credit, or the few lenders that might allow you to borrow had high interest rates due to your poor credit history, then you may understand the importance of building a good credit profile. When situations come up where you need quick cash with a poor credit history your only option can be applying for bad credit loans, which are usually high interest, not ideal, and best avoided if you find other options.

If you are in the bad credit group, it is in your best interest to take a serious interest towards improving your credit score and start now, because it takes time and won’t happen overnight.

Better Opportunities

Having a good credit score can affect more than just your ability to get a loan, it can have a positive effect on your finances in a few ways. It’s important to think beyond loan uses and consider the many benefits of having a good credit score available to you.

With a good credit score you might be eligible for:

– Credit cards with higher limits, more rewards or perks

– Better interest rates or terms for personal and installment loans

– An increase in the amount you can borrow in future

You may also experience better insurance rates, more likely your rental application is approved, more employment opportunities, being able to avoid security deposits on utilities, and even some negotiating power when it comes to loan terms.

Average Credit Scores by Province and City in Canada

| Alberta | Calgary – 665 Edmonton – 645 |

| British Columbia | Vancouver – 703 Surrey – 697 Burnaby – 668 Victoria – 691 |

| Ontario | Toronto – 694 Mississauga – 690 Brampton – 667 Hamilton – 653 Ottawa – 685 Kitchener – 679 |

| Quebec | Montreal – 690 Quebec City – 668 Laval – 679 |

| Nova Scotia | Halifax – 658 |

| New Brunswick | Moncton – 632 |

| Manitoba | Winnipeg – 657 |

| Saskatchewan | Regina – 659 Saskatoon – 656 |

The amount of debt you carry can also influence your score. It’s worth noting that the larger cities tend to have a higher credit score average, which may be related to having more economic opportunities to choose from.

RELATED: Should You Improve Your Credit Score Before Applying for a Personal Loan

According to the Transunion credit bureau the average credit score of Canadians is about 650, while Equifax suggests an average credit score by age range.

Average Credit Scores Age in Canada

Age | Score |

18 – 25 | 692 |

26 – 35 | 697 |

36 – 45 | 710 |

46 – 55 | 718 |

55 – 65 | 737 |

65 + | 750 |

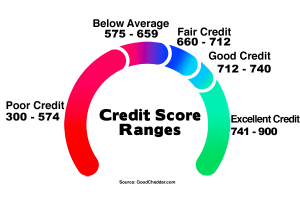

Your overall credit health is a way for others to recognize your creditworthiness and whether you might pose a risk to lenders. A credit score in Canada is a three digit number that is between 300 to 900 and suggests to lenders a basic reference about your credit profile, which would include your payment history, types of credit used, age of credit history, types of inquiries, credit utilization, total credit debt and how much of your credit is available to use.

RELATED: What Credit Score is Needed for an Online Loan

3 Quick Tips for a Better Credit Score

There are lots of great suggestions on ways you can improve your credit score, but if we were to keep that list short and limit it to a few, we would suggest the following:

- Make payments on time

- Keep your credit utilization below 30%

- Maintain a good mix of credit types

This doesn’t mean the others are not also important. But if we were to short list just a few, this would be our top 3 suggestions to keep in mind.

You should also know that your debt to income ratio (DTI) is not part of your credit score but it is something that many lenders also look at and may consider when reviewing an application.

For those that are new to Canada and confused by credit scores we have put together our own credit score guide for newcomers that can be helpful with understanding how it works.

Many Canadians deal with credit card debt, which when not properly managed can slowly affect their credit score as well.

Please also refer to the following for personal loan insights:

- 5 Things to Know When Looking for Personal Loans

- What to Know About Canadian Personal Loan Rates

- What to Know Before You Apply for Personal Loans

- What to Know About Installment Loans

- What Are Your Options to Borrow in Canada?