Best Money Apps for Finances in Canada

Many people are not that great at keeping track of their expenses, and while some might know the larger outgoing costs, lots of people don’t know their everyday expenses.

While many Canadians don’t think it’s necessary, some say they don’t have the time or energy, and a few mention they don’t bother because they know they’ll overspend anyway.

Budgeting doesn’t have to be painful. In fact, you’re likely to come out ahead knowing your finances, allowing you to plan better, save more, and take care of your debt. While it can be a struggle in the beginning, but when you have awareness of your money it only helps you to manage what you have available to spend.

Why Is Budgeting Important?

Spending is easy, but budgeting is another story. Besides making smarter decisions and keeping track of your finances, you have to resist impulse buys and retail therapy to make it work. Sticking with a budget is a big part of making it work, and creating one is only the beginning. This can involve changing habits, along with developing new ones.

Budgeting helps you to track finances, possibly pay your debt sooner, create financial stability, and create a plan for future wants. It can also help to identify poor spending habits, achieve your financial goals, and assist with putting something aside for an emergency fund.

With a proper budget, it can also help you to avoid spending money you don’t have, which can help you avoid digging yourself further in debt.

‘About half (49%) of Canadians report having a budget..’

– Survey for Canadian Financial Capability Survey (CFCS)

When you create and stick with a budget, you are more likely to live within your means. It provides insight on how much you have earned, what you can afford to spend each month, and how much you have leftover after the bills to sock away and save. Once you start doing it, you’ll not only be able to better manage your finances, you can also plan for things like a big purchase or trip you’re interested in as well.

RELATED: Building a Budget That Works

Budgeting Apps To Know

Most banks like RBC, CIBC, BMO, Scotia and TD offer an app to manage your bank account. It usually does the job and might also include additional features within the app such as budgeting. Often you’ll find more powerful versions of budgeting and tracking apps from the examples below which are more focused on tracking your expenses and budgeting your money. In many cases you can compare. The app from the bank is usually free, as well as several of the option below. If you enjoy the features and options, you might consider upgrading.

Mint

Many say that Mint is one of the best all around personal finance apps, and we tend to agree. Not only can you track expenses and monitor your credit score, it also has reminders so you’re never late with a bill payment again. It also helps you to improve your spending habits and tackle your debt. Packed with features, it can put an end to spreadsheets, and make managing your money even more simple. It’s also free. Update: Mint is being discontinued and will be shut down Jan. 1, 2024 with users being encouraged to migrate over to Credit Karma.

PocketGuard

If there is one thing that PocketGuard does really well, it’s helping you to track your spending. It keeps a running tab of how much that you have left to spend, along with how many days you have to make it last. The the app’s Insights tool is also really handy for figuring out where you tend to spend most of your money on a regular basis as well.

YNAB (You Need a Budget)

For people living paycheck to paycheck, YNAB can be a great app for getting your finances under control. It requires you to assign a ‘task’ to every dollar you earn, requiring you to be intentional with the money you earn each month. It might cost $11.99 monthly, but YNAB says new budgeters save $6,000 in their first year on average.

Simplifi

With personalized spending and real time updates the Simplifi app (by Quicken) also tracks your monthly bills and subscriptions, making it another standout. It’s great for monitoring cash flow due to its tracking capabilities, telling you what you have to spend between your paycheques.

Personal Capital

The tools from Empower (formerly Personal Capital) might be for wealth building, but you can still track your finances and it comes with some handy budgeting features and automated tracking of purchases from linked accounts.

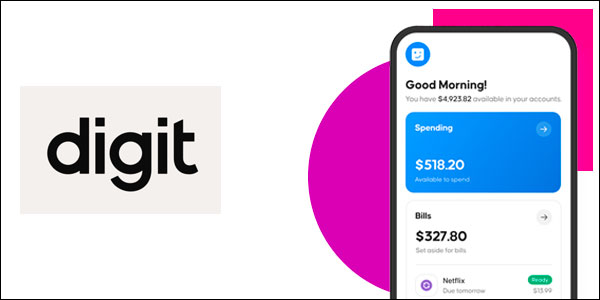

Digit

Using automation to help save money while covering expenses, Digit will analyze your spending patterns of things like upcoming bills to help determine what the appropriate amount is to set aside in savings each day, making it a unique way to maximize your savings.

Wally

A popular choice for family budgeting, Wally provides insights on spending, helps set goals, and assists you with creating a budget that can suit your needs. The insights and real-time updates but it’s the higher level of control such as budgeting specifically by category that make it appealing.

Goodbudget

Based on the envelope-based method, many will find Goodbudget offers all that is needed to manage household finances for most couples or families. There’s also an upgrade option to Plus for more complicated budgets.

Zeta

Designed for couples who want to manage money together, Zeta provides details on spending and assets. They can also message each other about transactions and allows partners to split purchases through the app.

EveryDollar

For those interested in building a budget quickly, EveryDollar might be an option to look at. It can help with and can help with managing money, paying off debt, and saving for retirement.

MORE: How a Personal Loan Can Help Pay Off Your Debt Faster

Alternative Apps to Explore

Other personal finance apps worth knowing which are not true budgeting apps but can also be helpful with budgeting might include:

Koho

Using Koho can help you save, track, and even earn rewards. You can also earn cashback and use it to help build your credit.

Moka

Take a look at Moka if you’re interested in an app that can put your spare change into an investment account, rounding up everything you spend to help build your account. Formerly called Mylo.

Neontra

One look at Neontra and you may find it offers everything you could want and more, budgeting and planning to tracking, investing and more.

Truebill

Using Truebill can assisting you staying on top of your budget and spending by helping you with cutting your bills, allowing you to save more, and spend less.

Acorns

While Acorns isn’t strictly a budgeting app, you could say it’s more of a savings app. It rounds up your purchases to the nearest dollar and invests the change in a savings account.

Dollarbird

You’ll find some great financial planning features at Dollarbird that allows you to track and see where your money goes with calendar based personal finance.

MORE: What is a Good Credit Score

Even More Money Apps

More apps you can look into that can help you with your money include GasBuddy, Flyerify, RedFlagDeals, Flipp, Caddle, Wealthsimple, JoinHoney, Checkout 51, Mogo, Too Good To Go, Flash Food, Eclipsa, Receipt Hog, Rakuten,

Or take a look at some of these cashback apps brought to by well known banks, such as Ampli (RBC) or Paymi (CIBC).

Your Budgeting Starts Now

In a recent study, about 39% of people say they don’t save anything because their expenses don’t allow it. This can be linked to a lack of monitoring, budgeting, and money awareness. When it comes to budgeting, it’s a big part of financial literacy.

Those that track their money are less likely to have money issues because their budget tells them what they have, where the money goes, and allow for planning their financial spending and/or saving.

Money is often the main source of stress, and using a budget to monitor, track and manage your spending and expenses can alleviate some of that stress. While you can do things the old fashioned way, budgeting apps have made it much easier and more convenient.

If you haven’t already started a emergency fund to have on standby, this is also recommended since it can help you get through times of unexpected expenses more easily. Read more on creating a fund for emergencies and how you can get started.

Recommended Reading:

- How to Money – Budgeting Basics

- How to Lower Your Bills and Save

- 10 Debt Repayment Methods to Know

- 5 Smart Money Moves for Personal Finance